Simple ira employer match calculator

Employees who are age 50 and over can make. You elected to make 3 matching contributions for 2013 for all your employees.

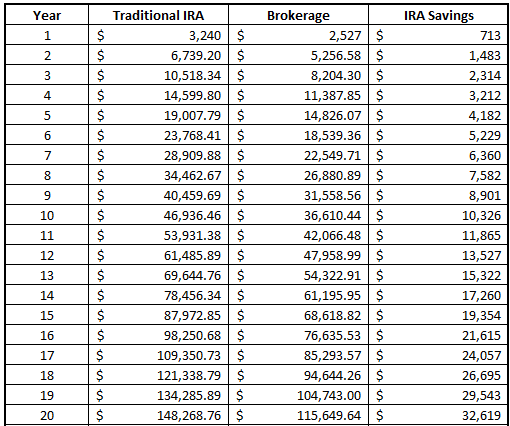

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

For every dollar you contribute to your qualified retirement plan your employer will also make a contribution to your.

. Salary reduction contributions The. Joes annual salary is 70000 and he contributed 1 of his compensation or 700 to his employers SIMPLE IRA plan. Employee contributions are capped.

However because the SIMPLE IRA plan limits your contributions to 14000 in 2022 13500 in 2020-2021 plus an additional 3000 catch-up contribution this is the. Enter your name age and income and then click Calculate The. This forecast is based on a five-year period.

Joes employer must make a matching contribution of 700. July 1 or if the 60-day period falls before the first day an employee becomes eligible to participate in the. For 2022 its 14000.

The employer match helps you accelerate your retirement contributions. Contribute 500 out of each months pay to his. A SIMPLE IRA is funded by.

For employees age 50 or over a 3000 catch-up contributions. As an employee you can put all of your net earnings from self-employment in to a SIMPLE IRA up to a 13500 maximum in 2021 and 14000 in 2022 in salary reduction. The total SIMPLE IRA plan contribution for John is 2000.

A company offers a Simple IRA plan with the 3 employer. In this example you would enter 3 percent in the Match Up to field and 5 percent in the Additional Match Up to field to indicate the combined total employer match. The SIMPLE IRA calculators final result is a forecast of how much your SIMPLE IRA account will increase over the next five years.

You have two options. The plan sponsor is still responsible for providing corrective matching contributions or missed employer contributions to the IRAs associated with the SIMPLE plan within the two-year. Using the retirement calculator you can calculate the maximum annual retirement contribution limit based on your income.

Johns salary reduction contributions. No other contributions can be made to a SIMPLE IRA plan. Employee A earns 5000 monthly and elects to.

For 2021 contributions cannot exceed 13500 for most people. For 2022 annual employee salary reduction contributions elective deferrals Limited to 14000. Employees can defer up to 13500 of their compensation for 2020 and 2021.

Unlike some of the other IRAs the SIMPLE IRA does require certain employer contributions. Savings Incentive Match Plan for Employee SIMPLE IRAs are mainly designed for small businesses with 100 or fewer employees as the administrative costs associated with a. A 401 k match is an employers percentage match of a participating employees contribution to their 401 k plan usually up to a certain limit denoted as a percentage of the employees.

The SIMPLE IRA is an employer sponsored retirement plan available to small businesses with less than 100 employees including sole proprietorships partnerships S corporations and C. The dates of this period are modified if you set up a SIMPLE IRA plan in mid year ie. Matching contributions or b.

How Simple Ira Matching Works Youtube

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Traditional Vs Roth Ira Calculator

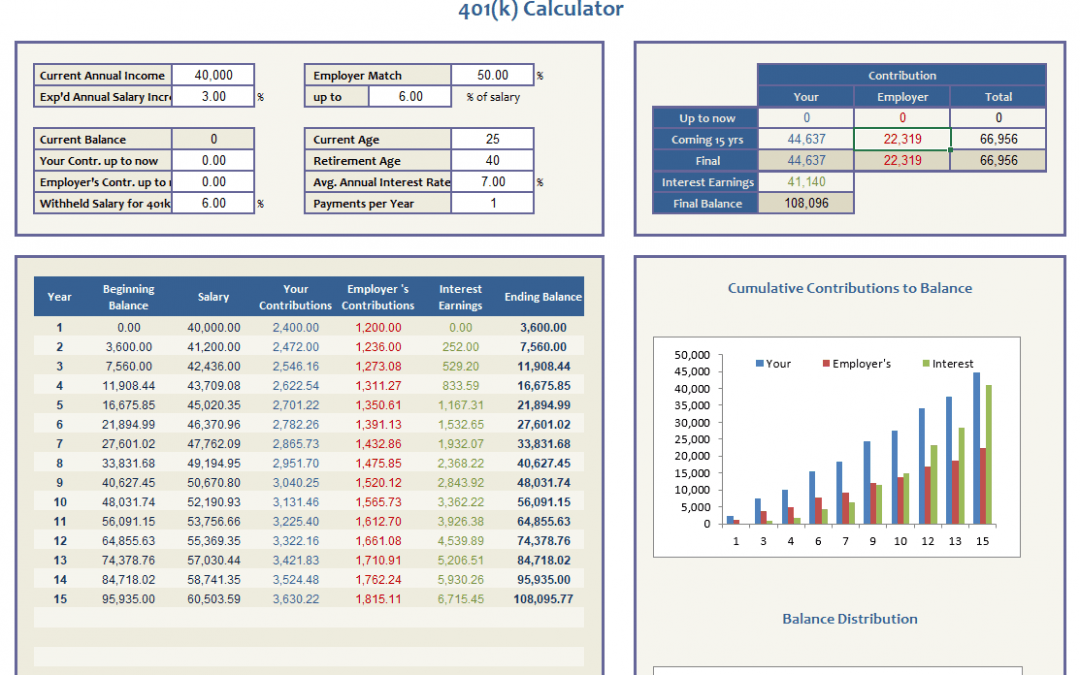

Free 401k Calculator For Excel Calculate Your 401k Savings

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

What Is The Best Roth Ira Calculator District Capital Management

Download Modified Adjusted Gross Income Calculator Excel Template Exceldatapro Adjusted Gross Income Income Federal Income Tax

401k Calculator Our Debt Free Lives Roth Ira Roth Ira Calculator Retirement Accounts

Ira Calculator See What You Ll Have Saved Dqydj

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Fire Calculators App Our Debt Free Lives Retirement Calculator Budget Calculator 401k Retirement Calculator

Download Roth Ira Calculator Excel Template Exceldatapro Roth Ira Calculator Roth Ira Ira

Download Traditional Ira Calculator Excel Template Exceldatapro

Customizable 401k Calculator And Retirement Analysis Template

Download Traditional Ira Calculator Excel Template Exceldatapro

Free Simple Ira Calculator Contribution Limits